One of my early investments turned out to be a mistake—and it cost me nearly ₹10 lakhs.

With falling interest rates, a 15-year lock-in, annual compounding, and no liquidity, this investment hasn’t aged well. In hindsight, it wasn’t the best choice. In this post, I’ll walk you through what the instrument was, why I chose it, how it worked out, and whether it still holds up in today’s context.

How It All Started

I began investing in 2013. One of my very first investments was in the Public Provident Fund (PPF). At the time, the main reason I opted for PPF was its tax benefits.

PPF qualifies for deductions under Section 80C—meaning investments up to ₹1.5 lakhs could be reduced from your taxable salary. It also offers EEE status (Exempt-Exempt-Exempt):

- Exempt at investment

- Exempt on interest

- Exempt on maturity

This triple-tax benefit made it one of the most attractive debt investments, especially for risk-averse investors or those looking to balance their equity-heavy portfolios.

Though I wasn’t risk-averse myself, I wanted to include a debt component as part of my retirement planning. So I started investing ₹5,000 per month in PPF. (I also began SIPs in mutual funds around the same time—but I’ll save that story for another post.)

Fast-forward to now: in light of the new tax regime and falling interest rates, I feel PPF has lost much of its shine.

What’s Changed?

With the introduction of the New Tax Regime, tax-saving instruments like PPF have become almost irrelevant for many. The new slabs offer better savings, and the tax you save can now be redirected into better-performing assets.

The Decline in Interest Rates

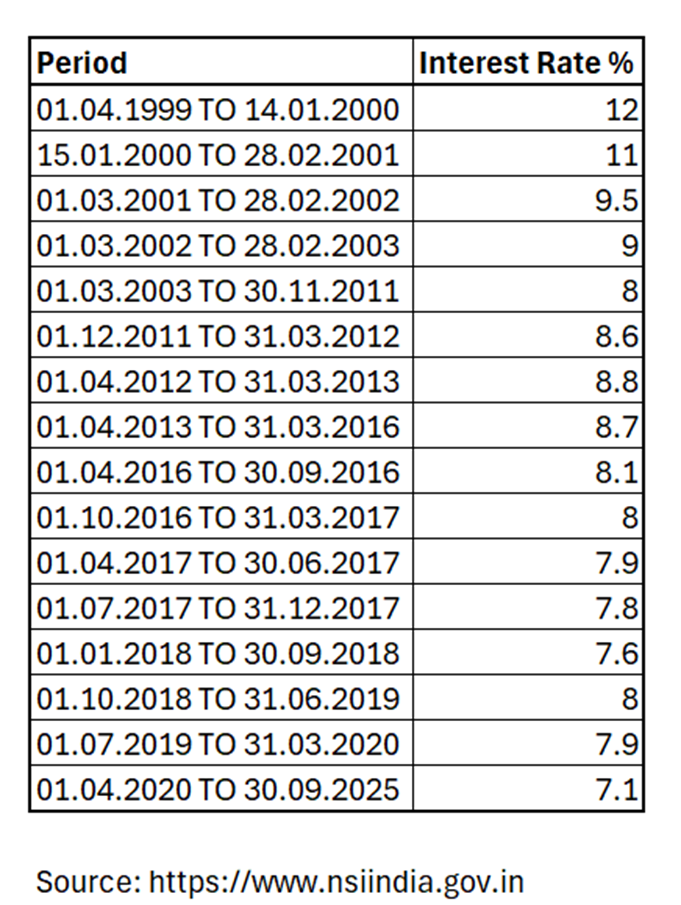

Here is a snapshot of PPF interest rated over the last 20+ years:

Here’s the real issue:

PPF interest rates have been falling for two decades.

From a high of 12% in 2000, the rate now stands at 7.1% in 2025. And chances are, it will only hover around or below the inflation rate going forward.

That’s not great news for long-term investors. You’re essentially locking your money in a low-growth instrument for 15 years. Add annual (instead of monthly) compounding to the mix, and it really begins to eat into your wealth over time.

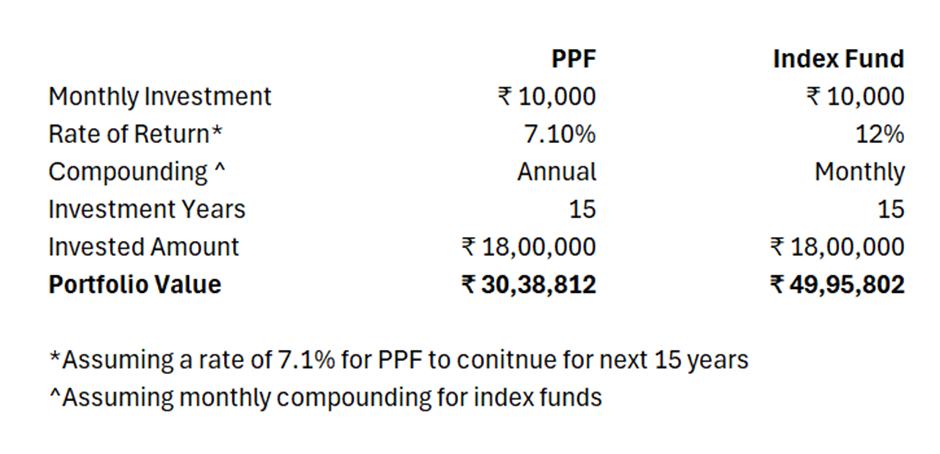

If you invest the same amount (say, ₹10,000/month) in a low-cost index fund for 15 years, you’re likely to build a significantly higher corpus than PPF—despite losing the tax deduction.

Is PPF Still Relevant for Retirement?

Let us look at an example. Say you are investing 10,000 per month in PPF and 10,000 per month in an index fund. You continue investing for a period of 15 years, here is how much you will have accumulated at the end of 15 years.

You are losing out ~₹20 Lakh by investing in PPF.

So, is PPF suitable for long-term retirement planning?

My honest answer: No.

What Can You Do If You’re Already Invested?

If you’ve already been contributing to PPF, unfortunately, early withdrawals are restricted unless you’re facing a medical emergency or funding higher education.

But here’s what you can do:

- Stop contributing the full amount. Keep your PPF account active with the minimum ₹500–₹1,000 per year.

- Redirect your monthly investments to:

- Equity Mutual Funds

- Direct Equity (if you’re comfortable)

- Index Funds (simple and cost-effective)

Stay invested in these alternatives for the same duration—or longer—and you’re likely to come out much better by the time you retire.

Final Thoughts

I don’t regret the PPF investment entirely—it taught me a valuable lesson early in my financial journey.

But if you’re just starting out or rethinking your long-term strategy, take a moment to look beyond tax benefits. Understand the trade-offs. Not all traditional investments age well in a changing economy.

It’s okay to shift your strategy once you have better information. That’s how you grow—as an investor and as a planner of your future.