In my last post, I wrote about a common FOMO every parent feels—Will my child lose out in life if they don’t get a premium education? Foreign education or not, one thing is certain—you must start investing for your child’s education early. It’s a long-term goal, and the earlier you start, the better.

Now, the big question: How should I plan for my child’s education goal in India? Which is the best asset class? How much should I invest each month? And—should I just go for those children-specific mutual funds that promise to take care of my child’s education?

Let’s break it down.

What Are Children-Specific Mutual Funds in India?

Many mutual fund houses offer solution-oriented mutual funds for child’s education, and insurance companies also package similar offerings. These are marketed as tailor-made for your child’s future with emotional messaging— “Secure your child’s future today.”

Marketeers of these funds make you believe that investing in these funds is a sure shot way to secure your child’s future —but are they really unique? Do they invest in any special investment vehicles to help parents achieve their dream of funding their children’s education?

Answer is NO.

These funds typically invest in the same underlying asset classes—equity, debt, and sometimes gold/commodities—just like any other mutual fund. Most of them fall under the hybrid category, meaning they invest in a mix of equity and debt.

What is different is the lock-in period—often a minimum of 5 years—unlike other open-ended mutual funds that offer more liquidity.

What’s with the Lock-In Period?

These solution-based mutual funds for child’s education come with a lock-in period of at least 5 years.

That’s not always a bad thing.

A lock-in period:

- Encourages financial discipline

- Shields you from panic-selling during market dips

- Gives fund managers some breathing room to invest long term

- Supports long-term wealth creation through compounding

However, it also comes with a downside—what if the fund underperforms even when the market is doing well?

Being stuck in a poorly performing fund with no exit option can really drag your portfolio down. And let’s not forget—you’re investing for your child’s future. Flexibility matters.

Should You Invest in Children-Specific Mutual Funds for Education?

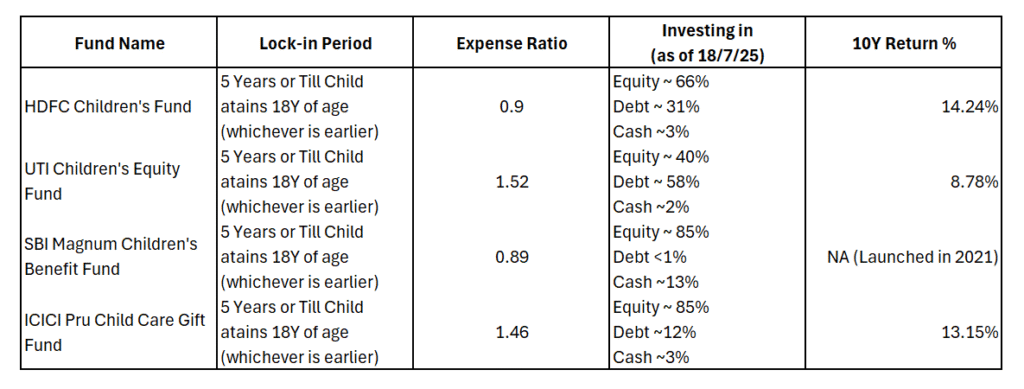

Let’s look at some children-specific mutual funds in the market:

As you can see, all these funds have a lock in period of at least 5 years, and if you look at their asset allocation it is very similar to asset allocation of Hybrid funds. Even the returns of some of these funds are lower than the average market return during the same period.

These are just Hybrid equity funds masquerading under a different name.

So, Should You Invest in Them?

If you’re someone who:

- Gets anxious with market volatility

- Benefits from the discipline a lock-in brings

Then yes, these funds might work for you.

But if you’re already a disciplined investor who can stay invested during market ups and downs, you’re better off choosing:

- A pure equity fund for long-term goals

- A hybrid fund if your risk appetite is moderate

Either of these options can work as long as your investment strategy aligns with your goals, time horizon, and risk tolerance.

How to Plan for Child’s Education the Right Way?

There is no magic fund that will take care of your child’s education. But a simple SIP in a well-chosen mutual fund, combined with time and discipline, can work wonders.

Here’s what you can do:

- Start early (ideally when your child is born)

- Choose equity mutual funds or hybrid mutual funds based on goal horizon

- Use the SIP + step-up SIP approach to boost contributions as income grows

- Stay invested through market cycles

Bottom Line

Don’t fall for marketing gimmicks.

Children’s mutual funds in India may sound promising, but they’re not necessarily better than other options.

Focus on starting early, staying consistent, and reviewing your portfolio regularly.

At the end of the day, there’s no magic pill. Time and consistent behavior will do the magic—not a fund wrapped in emotional marketing.