A while ago, I came across a post on LinkedIn where Radhika Gupta from Edelweiss AMC mentioned that she’s building a ₹10 crore corpus for her son’s higher education. That number stopped me in my tracks.

Here I am, working toward a ₹10 crore retirement corpus—something I hope will sustain me for 50+ years—and someone else is building a ₹10 crore education fund for just 4 years?

That’s when it hit me: education costs are at an all-time high, and education inflation keeps rising every year. On top of that, we parents are being pulled into a state of FOMO. We’re made to believe that if we don’t provide a foreign or “premium” education, our children will somehow be left behind.

Naturally, parents want the best for their children. But what we often overlook is this: in trying to fund an expensive education, we might be quietly robbing ourselves of a peaceful retirement.

The Trade-Off No One Talks About

Let’s face it—time and money are limited resources for most of us (unless you’ve already built generational wealth). I’m assuming you, like me, live paycheck to paycheck or depend on a consistent source of income to fund both your lifestyle and your goals.

So, every rupee you allocate towards a high-end foreign degree for your child is money not going toward your retirement fund. This isn’t about choosing one over the other—it’s about understanding the consequences of prioritizing one without thinking it through.

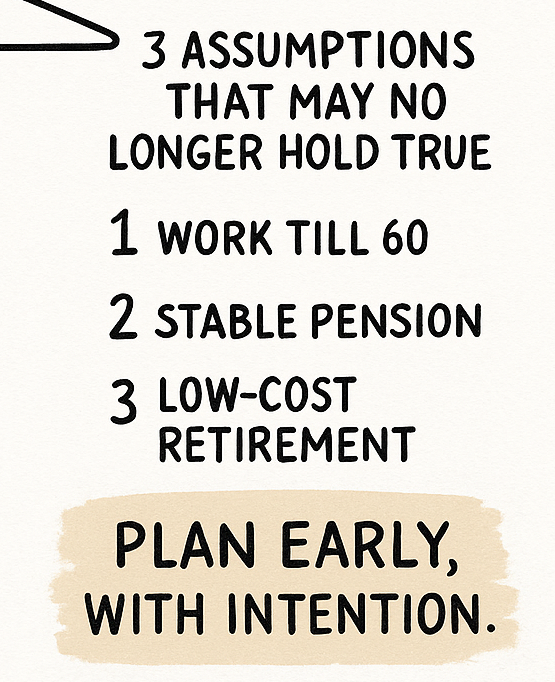

3 Assumptions That Worked for Our Parents—But May Not for Us

1. Retirement age is 60

Many people think of retirement as a faraway goal—they assume they have 30 years to plan and save. But that’s based on the idea that we’ll work until 60. In reality, that may not hold true anymore.

With technology evolving rapidly and AI taking over certain roles, job security isn’t what it used to be. In the past, your 40s and 50s were considered the golden period of your career. Today, being 45+ might actually put you at risk—especially in mid-level roles, where companies often cut costs.

So instead of planning for the best-case scenario (working till 60), it’s wiser to plan for the worst. If things go better than expected, you’ll have a surplus—not a shortfall.

2. You’ll have a stable pension

The defined benefit pension plans our parents enjoyed are almost extinct. No company today promises to pay you a lifelong pension. The responsibility of building a retirement corpus now falls entirely on us.

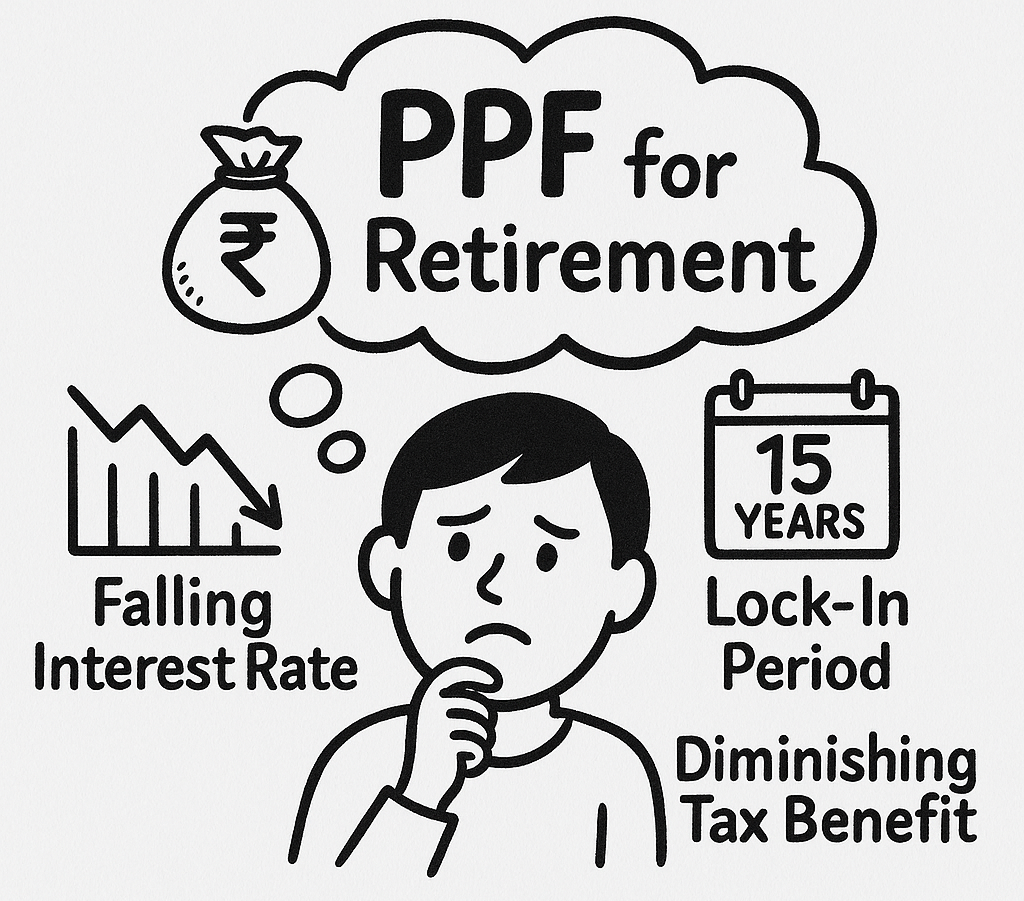

And traditional retirement vehicles like PPF or EPF? While useful, they offer fixed interest rates that are slowly declining and may not beat inflation over the long term. Relying on them as your primary retirement tool is an outdated approach.

3. Post-retirement life will be simple

Our parents’ retirement goals were often modest—enjoying a peaceful rhythm, spending time with family, tending to hobbies. But our generation? We want more.

We want to travel, upgrade our lifestyle, maybe even start a second act. Add rising healthcare costs to the mix, and the retirement corpus we’ll need is significantly larger than what our parents required.

So, What’s the Answer?

The idea isn’t to question anyone who dreams of giving their child a world-class education. Nor is it to say retirement should be your only goal. But we do need to pause and ask ourselves:

What’s driving our financial decisions?

Is it fear of missing out? Social pressure? Guilt?

Financial planning isn’t about denying your child opportunities—it’s about making sure you don’t burn yourself out in the process. Because let’s be honest: your child doesn’t want to see you stressed and financially insecure either.

In fact, a grounded approach to money sets a better example for them than sending them to a fancy university ever could.

There doesn’t have to be a trade-off—both goals are valid and important. The key lies in setting clear priorities and planning for them early and intentionally. So whether you’re building a fund for your child’s future or your own retirement, ask yourself:

Are you chasing what matters to you, or what the world told you should matter?